The current financial ecosystem is riddled with inefficiencies, lack of trust, and regulatory challenges.

Traditional finance (TradFi) struggles with high costs, manual processes, and limited innovation, while crypto based DeFi face issues of compliance, interoperability, and consumer protection.

Lack of compliance and oversight with the following undesirable consequences:

- Limited interoperability with traditional financial infrastructure

- Outright prohibition by many regulators around the world

- No consumer protection resulting in low trust levels among potential end-users

Traditional financial assets and services suffer from a number of structural challenges which make them sub-optimal in many ways

- Huge counter-party risk associated with custody

- Cumbersome and ineffective regulatory oversight

- High cost of human labor and associated brick and mortar infrastructure

- Delays, errors, and friction resulting from manual operation

- Impact of stringent but necessary controls on innovation

- Cost and time required to issue, store, move and process instruments

Challenges with Crypto

xLack of compliance and oversight with the following undesirable consequences:

- Limited interoperability with traditional financial infrastructure

- Outright prohibition by many regulators around the world

- No consumer protection resulting in low trust levels among potential end-users

Challenges with TradFi

xTraditional financial assets and services suffer from a number of structural challenges which make them sub-optimal in many ways

- Huge counter-party risk associated with custody

- Cumbersome and ineffective regulatory oversight

- High cost of human labor and associated brick and mortar infrastructure

- Delays, errors, and friction resulting from manual operation

- Impact of stringent but necessary controls on innovation

- Cost and time required to issue, store, move and process instruments

INTRODUCING REGULATED BLOCKCHAIN

Regulated blockchain leverages the programmability, transparency and immutability of blockchain to ensure that digital assets and applications are compliant and regulators have the required oversight.

Regulations are programmatic and compliance is enforced

Assets and instruments are represented in purely digital form

All instruments reside on-chain and do not require custody

Product and service operations are completely automated

Processes behind product functionality are audited and immutable

Complaint

xRegulations are programmatic and compliance is enforced

Paperless

xAssets and instruments are represented in purely digital form

Non - custodial

xAll instruments reside on-chain and do not require custody

Automated

xProduct and service operations are completely automated

Transparent

xProcesses behind product functionality are audited and immutable

Core Components

Regulated Blockchains are made up of four distinct layers each contributing to the smooth functioning of a simple and efficient value chain.

Core Infrastructure

Provides the ledger, runtime environment and other native functionality that facilitate the issuing of digital assets and delivery of financial apps

Regulatory Applications

Provides programmatic rules and enforcement mechanism to constrain the behaviors of assets, applications and service providers

Product Ecosystem

Consists of the digital assets and apps built by various service providers to address diverse needs of end-users

End-User Interfaces

Consists of third party applications through which individuals and organizations consume financial services offered on Regulated Blockchains

Core Infrastructure

The Core Infrastructure of Regulated Blockchains provides the foundational layer for secure, compliant, and efficient financial services

Network Nodes are licensed by relevant regulators within each applicable jurisdiction.

- Nodes -Are hosted by regulators and regulated institutions.

- Connectivity Is via a virtual private network.

- Consensus is based on proof of authority protocol.

A decentralized and synchronized transaction database that ensures transparency, immutability, and real-time updates across all participating nodes.

A fee structure that balances commercial and non-commercial validators, prioritizing cost efficiency while incentivizing network developers and administrators

Validator and archival nodes that maintain ledger integrity, verify transactions, and enhance network security by preventing unauthorized modifications

Cryptographic techniques and anonymization protocols safeguard transactions, ensure data integrity, and provide regulators with controlled visibility

A Proof of Regulation (PoR) model where only licensed financial institutions operate validator nodes, ensuring compliance and deterring fraudulent activity

PA distributed execution environment that runs smart contracts securely and tamper-proof, ensuring compliance and consistency in financial operations

Economics

xA fee structure that balances commercial and non-commercial validators, prioritizing cost efficiency while incentivizing network developers and administrators

Shared Ledger

xA decentralized and synchronized transaction database that ensures transparency, immutability, and real-time updates across all participating nodes.

Network Nodes

xValidator and archival nodes that maintain ledger integrity, verify transactions, and enhance network security by preventing unauthorized modifications

Nodes Connectivity

xNetwork Nodes are licensed by relevant regulators within each applicable jurisdiction.

- Nodes -Are hosted by regulators and regulated institutions.

- Connectivity Is via a virtual private network.

- Consensus is based on proof of authority protocol.

Security and Privacy

xCryptographic techniques and anonymization protocols safeguard transactions, ensure data integrity, and provide regulators with controlled visibility

Consensus Algorithm

xA Proof of Regulation (PoR) model where only licensed financial institutions operate validator nodes, ensuring compliance and deterring fraudulent activity

Application Run-Time

xA distributed execution environment that runs smart contracts securely and tamper-proof, ensuring compliance and consistency in financial operations

PRODUCT ECOSYSTEM

The Product Layer enables the creation, automation, and self-custody of digital financial products on Regulated Blockchain

PRODUCT ECOSYSTEM

The Product Layer enables the creation, automation, and self-custody of digital financial products on Regulated Blockchain

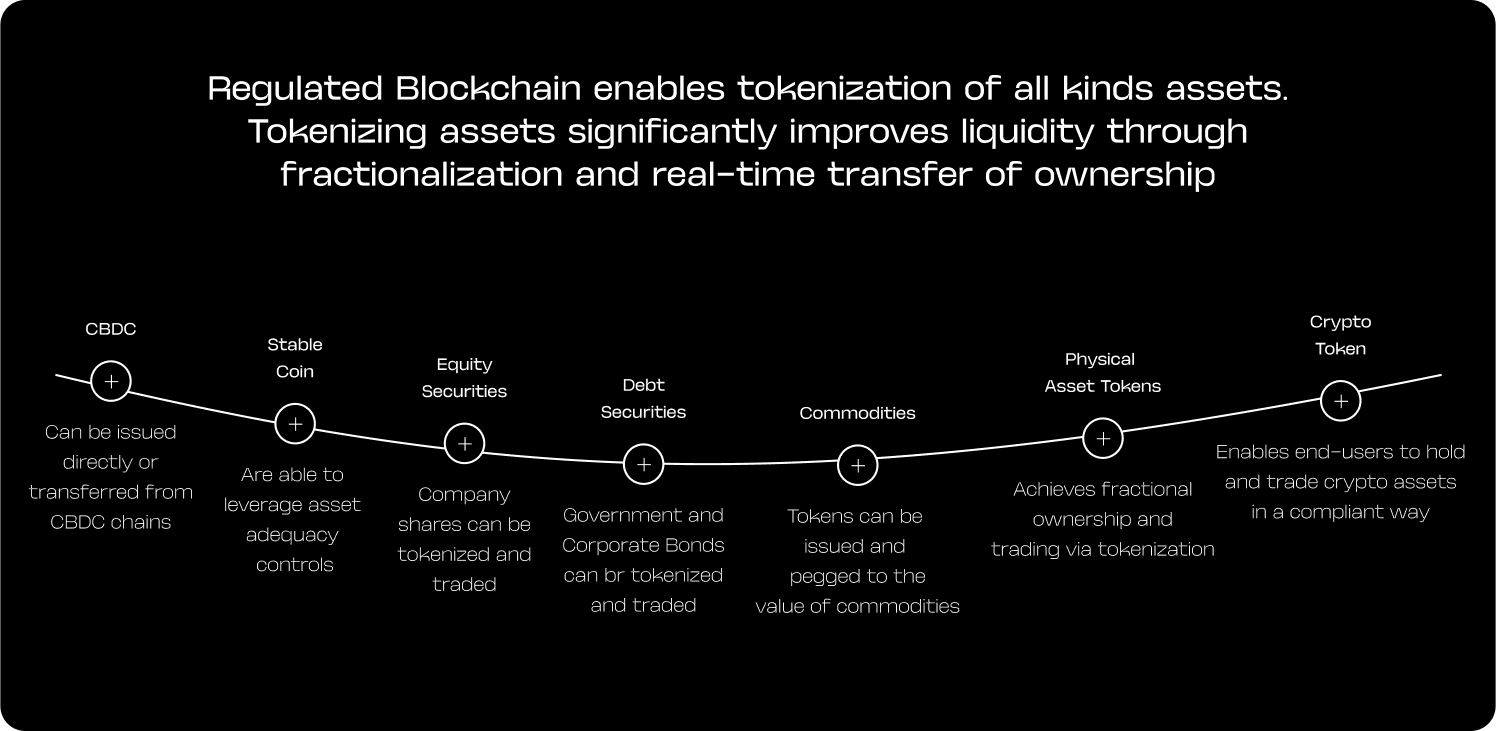

Regulated Blockchain enables tokenization of all kinds assets. Tokenizing assets significantly improves liquidity through fractionalization and real-time transfer of ownership

CBDC

Can be issued directly or transferred from CBDC chains

Stable Coin

Are able to leverage asset adequacy controls

Equity Securities

Company shares can be tokenized and traded

Debt Securities

Government and Corporate Bonds can be tokenized and traded

Commodities

Tokens can be issued and pegged to the value of commodities

Physical Asset Tokens

Achieves fractional ownership and rading via tokenization

Crypto Tokens

Enables end-users to hold and trade crypto assets in a compliant way

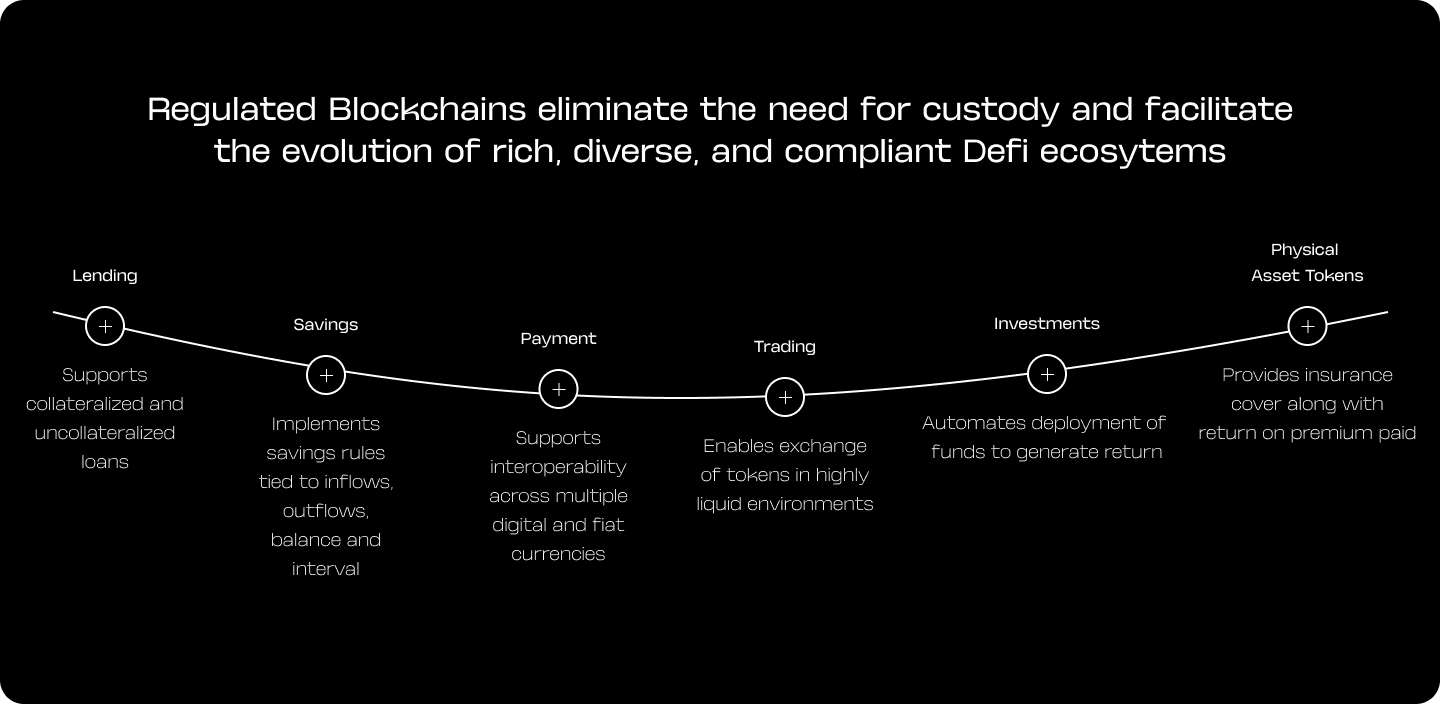

Regulated Blockchains eliminate the need for custody and facilitate the evolution of rich, diverse, and compliant Defi ecosytems

Lending

Supports collateralized and uncollateralized loans

Savings

Supports collateralized and uncollateralized loans

Payment

Supports collateralized and uncollateralized loans

Trading

Supports collateralized and uncollateralized loans

Investment

Supports collateralized and uncollateralized loans

Physical Asset Tokens

Supports collateralized and uncollateralized loans

EXTERNAL INTERFACE

The External Interface layer Provides Seamless access to Regulated Blockchains through Graphic, Agentic, and Embedded Interfaces

Regulated Blockchain is designed to integrate effortlessly into the digital financial ecosystem, offering multiple ways for users to interact. Whether through menu-based interfaces, Agentic AI assistants, or embedded into enterprise financial applications, it ensures accessibility and usability across various channels. End-user interface providers deliver off-chain functionality that connects users to on-chain assets and services, enabling seamless interaction between Regulated Blockchains and the real-world.

Wallet Application

PFM Application

Payment Terminals

Payment Gateways

Financial Management Platforms

REGULATORY APPLICATION

Regulated Blockchains take advantage of blockchain’s characteristics to automate regulation. The regulatory applications layer within regulated blockchains applies three (3) main principles to achieve effective regulation of digital assets and financial services

Token templating ensures that digital assets are compliant by requiring issuers to use pre-built token issuance services that cater for all compliance requirements including

- KYC Assurance

Enforces submission of ID and implements restrictions based on KYC levels. - AML Screening

Enforces AML screening and suspected transaction reporting. - Custom Screening

Ensures that only transactions that have been screened, can effect a transfer of value.

- Transaction Parameter Validation Regulatory programmes validate actual transaction parameters against expected parameters as determined by predefined rules

- External Parameter Validation Regulatory programmes validate actual external records linked to each transaction against the expectation of what such records should be as determined by predefined rules

Regulated blockchain requires automated code screening and audits each time a new application or new version of an application is deployed.

- Compliance Screening

Confirms that the code base is compliant with relevant regulatory coding conventions. - Security Screening

Confirms that the code base does not contain fraudulent logic or malicious code snippets - Custom Screening

Ensures that only transactions that have been screened, can effect a transfer of value.

Token Templating

xToken templating ensures that digital assets are compliant by requiring issuers to use pre-built token issuance services that cater for all compliance requirements including

- KYC Assurance

Enforces submission of ID and implements restrictions based on KYC levels. - AML Screening

Enforces AML screening and suspected transaction reporting. - Custom Screening

Ensures that only transactions that have been screened, can effect a transfer of value.

Transaction Screening

x- Transaction Parameter Validation Regulatory programmes validate actual transaction parameters against expected parameters as determined by predefined rules

- External Parameter Validation Regulatory programmes validate actual external records linked to each transaction against the expectation of what such records should be as determined by predefined rules

Application Screening

xRegulated blockchain requires automated code screening and audits each time a new application or new version of an application is deployed.

- Compliance Screening

Confirms that the code base is compliant with relevant regulatory coding conventions. - Security Screening

Confirms that the code base does not contain fraudulent logic or malicious code snippets - Custom Screening

Ensures that only transactions that have been screened, can effect a transfer of value.

Regulated Blockchains are a radical departure from both crypto and TradFi yet, incorporate the best of both worlds and hold the key to unlock a golden age of financial services across the globe

Obi Emetarom